Top

The new Open Banking standard gives back to consumers full control of their data. As financial institutions adapt and evolve, delivering innovative new services becomes imperative to stay ahead of the competition.

Boost Innovation and Customer Loyalty

The new world designed by the Revised Payment Service Directive (PSD2) and Open Banking will offer a wide range of opportunities to organizations ready to embrace new technologies and innovative approaches. Complying with PSD2 will require financial institutions to put the customer at the heart of the value chain by building tools that respond to their needs and enable them to make informed financial decisions.

Financial institutions are leveraging the technology behind Open Banking as a strategic opportunity in their digital transformation journey. Banks possess the most valuable asset customers have to offer — their trust. And banks can further build on that trust through innovative approaches powered by progressive technologies that will strengthen their standing in the market and position them to become a trusted digital identity provider.

Going beyond simple compliance will mean:

- Creating superior customer experience

- Building agile core banking systems

- Offering innovative payment services

- Optimizing enterprise risk management

Intelligence-based Authentication

- Protecting user applications

- Deploying advanced multifactor authentication (MFA)

- Assessing threat and fraud detection in real time

Innovative Strategies

- Embracing open banking APIs

- Creating digital identities

- Becoming a trusted ID provider

Adaptive Security

Our Solution Portfolio

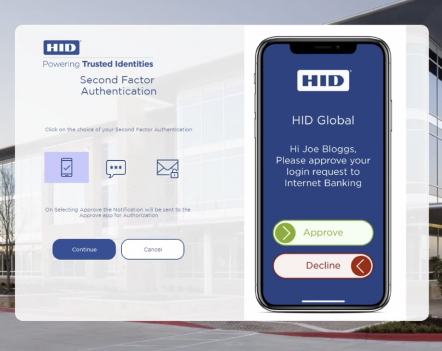

HID Global Integrates with Temenos Infinity to Create FinTech Solution

Temenos Infinity platform users can now benefit from the HID multi-factor authentication features to seamlessly secure their customer banking experience

- Enhanced usability while increasing security

- Increased customer acquisition and retention rates